The Global Sauces Market size was valued at USD 55.4 Billion in 2022 and the total Sauces revenue is expected to grow at a CAGR of 4.96 % from 2023 to 2029, reaching nearly USD 77.79 Billion By 2029. Sauces are liquid or semiliquid condiments that raise dishes by imparting flavor and moisture which crafted from diverse ingredients such as fruits, veggies, herbs, spices, and dairy. Sauces enhance meats, fish, veggies, and pasta. Tomatoes birth versatile tomato sauce, fermented soybeans yield salty soy sauce, meat or poultry drippings create a savory gravy, tomatoes, vinegar, sugar, and spices concoct sweet and tangy ketchup, and eggs, oil, vinegar, and lemon juice blend into creamy mayonnaise, enriching sandwiches, salads, and vegetables. The sauces market is driven by rising disposable incomes, urbanization, and evolving consumer tastes, it sees a rise in demand for ethnic sauces and home cooking. Key trends include premium sauce popularity, ethnic sauce growth, online sales rise, and a call for sustainable sauces. Rapid urbanization and hectic lifestyles drive a rise in demand for convenient, ready-to-eat meals and sauces. Increasing disposable income drives a preference for premium condiments, reflecting a willingness to spend more on gastronomic experiences. Health consciousness rises, with consumers recognizing the nutritional benefits of sauces such as soy sauce and the metabolism-boosting qualities of hot sauce. The fascination with diverse ethnic cuisines fuels a growing market for sauces such as teriyaki and hoisin. Continuous innovation by manufacturers caters to health trends, emphasizing natural ingredients and reduced sugar and fat content. The sauces and condiments market diversifies through segmentation by product type and distribution channels.To know about the Research Methodology :- Request Free Sample Report

Sauces Market Competitive Landscapes:

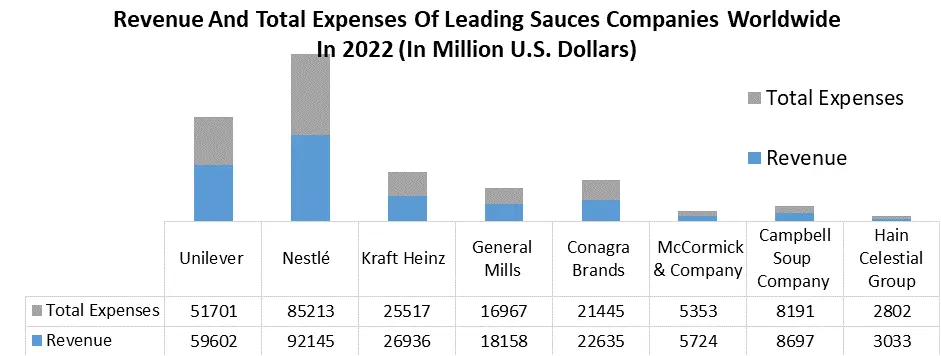

The Global Sauces market is expected to be highly competitive active presence of numerous market players. Major companies are striving to introduce cost-efficient and advanced implant-focused products to meet the increasing demand, consequently fostering overall market growth. Key players are adopting various business strategies, including technical partnerships and mergers and acquisitions (M&A) to remain competitive in the Sauces market. The industry includes a wide range of sauce areas, attracting both startups and well-established companies, thus contributing to the high market rivalry among market players. The market players are actively focusing on organic and inorganic strategies including mergers and acquisitions, product launches, geographical expansions, etc. For instance, 1. In June 2023, Kraft Heinz unveiled an innovative approach to captivate consumers' taste buds. They introduced six limited-time "Sauce Drops," collaborating with viral sensations such as Rebecca Black and William Hung. These unique sauces, such as Yuzu Wasabi and Black Garlic Ranch, aim to cater to adventurous eaters seeking diverse flavors. The move embraces "drop culture" and encourages real-time fan feedback, allowing the company to explore new flavor horizons and engage with consumers 2. In December 2022, Mutti, a leading Italian canned tomato company, expanded its product line by introducing new pasta sauces in the U.S. These sauces, including Marinara, Parmigiano Reggiano PDO, and Basil flavors are now available in various national and local retail chains. In March 2023, the Arrabbiata flavor sauce hit the shelves. This development demonstrated the growing trend of diversification and innovation within the global sauces market, catering to consumers' evolving tastes and preferences

Sauces Market Dynamics:

Increasing Consumer Demand for Variety and Flavor The sauce market is driven by factors that span global exposure, adventurous taste preferences, health consciousness, and the need for convenience. Increasing exposure to global cuisines, facilitated by travel, cooking shows, and social media, has sparked a keen interest in diverse culinary traditions. This curiosity particularly pronounced among millennials and Gen Z fuels a desire for exotic flavors and contributes to the rising demand for sauces that authentically replicate these tastes. Simultaneously, consumers are becoming more health-conscious, seeking sauces made with clean ingredients, devoid of artificial flavors, preservatives, and excessive sugar. The intersection of adventurous palates and health awareness has led to a sauce market for innovative flavors and healthier options. Also, busy lifestyles drive the demand for convenience, prompting sauce manufacturers to explore single-serve packets, squeeze bottles, and other portable packaging solutions. Additionally, Sauce manufacturers are responding dynamically, introducing a plethora of new and innovative flavors, increasing product lines to include both traditional favorites and ethnic specialties, and developing healthier options. Collaborations with chefs and influencers help create buzz and widen consumer reach. The future of the sauce market appears promising, driven by the ongoing trends of global culinary exploration, adventurous consumer preferences, health-conscious choices, and the need for convenient solutions. Manufacturers poised to meet these evolving demands will likely find success in this dynamic and ever-evolving industry. Global Flavors, Health Consciousness, And Personalized Trends Reform The Sauce Market The culinary landscape is undergoing a flavorful revolution driven by diverse consumer preferences. Adventurous palates are fueling a rise in demand for global flavors with a particular focus on ethnic sauces such as Korean gochujang, Indian tikka masala, and Mexican mole. Health-conscious consumers are shaping the market by seeking sauces lower in sugar, fat, and calories, leading manufacturers to introduce organic, plant-based, and gluten-free options. Convenience is paramount in today's fast-paced world, prompting the development of on-the-go-friendly sauces in single-serve packets and squeeze bottles. Sustainability and ethical sourcing concerns are driving demand for sauces made with responsibly sourced ingredients. Clean labeling is also on the rise, as consumers increasingly prioritize transparency in understanding the ingredients within their chosen sauces. Additionally personalization is emerging as a trend, with manufacturers utilizing data and technology, including AI, to craft sauces tailored to individual taste preferences. Functional ingredients, such as probiotics and antioxidants, are being incorporated to offer not just flavor but also health benefits. The blending of culinary borders in cross-cultural fusion is creating exciting new combinations appealing to a broad audience. E-commerce is reshaping the sauce market, enabling direct-to-consumer sales and providing consumers with greater access to a diverse array of sauces. Also, social media and influencer marketing play important roles, allowing manufacturers to connect with consumers, showcase products, and generate excitement around new launches. This dynamic landscape reflects an era where culinary exploration, health consciousness, convenience, and technology intersect to redefine the world of sauces. Rising Raw Material Costs The sauce market is grappling with a formidable challenge such as the rising cost of raw materials. The key ingredients such as tomatoes, spices, and herbs are experiencing price hikes attributed to various factors. Climate change-induced extreme weather events disrupt crop yields, while global incidents for example, The COVID-19 pandemic cause supply chain disruptions, elevating transportation costs and creating raw material shortages. Labor shortages in farms and processing plants contribute to higher labor costs, further squeezing profit margins for sauce manufacturers. Additionally, the rising costs of energy, such as fuel and electricity, amplify expenses in growing, processing, and transporting raw materials. Sauce manufacturers find themselves under pressure, prompting some to pass on increased costs to consumers, potentially affecting competitiveness as price-sensitive consumers seek more affordable alternatives. To navigate these challenges, manufacturers are exploring strategies such as reformulating products to reduce reliance on expensive ingredients, diversifying supply chains by sourcing from different regions, investing in automation to cut labor costs, and promoting premium products with higher profit margins. As the rising cost of raw materials persists, sauce manufacturers must continue implementing these multifaceted strategies to sustain profitability in the years ahead.Sauce Market Opportunities.

The sauce market is experiencing a rise in consumer demand driven by various factors such as the appeal of sauces as a convenient and quick method to increase flavor aligns with the increasing preference for convenience food products, catering to the needs of busy consumers. Additionally, a heightened awareness of the health benefits associated with certain sauces, such as those rich in vitamins, minerals, and antioxidants, is influencing consumer choices. The willingness to invest in premium sauces made from high-quality ingredients with unique flavors is another trend shaping the market. For sauce manufacturers, these trends open avenues for innovation and growth. Developing new and distinctive sauces, entering untapped markets, and collaborating with food service providers for broader distribution are among the opportunities. Key market trends include the increasing demand for clean-label sauces, a preference for artisanal and craft options, a focus on sustainable sourcing, and the personalization of products using data and analytics. Small businesses, in particular, carve a niche in the growing sauce market by targeting specific ethnic cuisines, offering innovative products, and building strong customer relationships. As the sauce market develops businesses that adapt to changing consumer preferences and embrace innovation are poised to thrive in this dynamic industry.Sauces Market Segment Analysis:

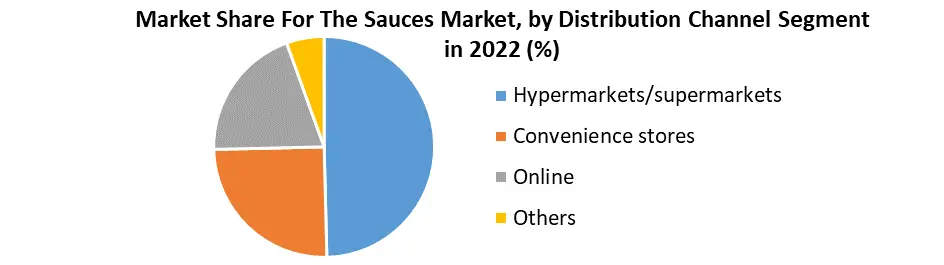

Based on the Distribution Channel, the supermarkets and hypermarkets segment held the largest market share and dominated the global Sauces market in 2022. The segment is further expected to grow at a CAGR and maintain its dominance during the forecast period. Supermarkets and hypermarkets are significant in the sauce market acting as the primary distribution hubs for an extensive array of sauces. Their dominance is attributed to several key factors. Firstly, these retail giants offer a diverse range of sauces encompassing various types, flavors, and brands, providing consumers with an extensive selection to meet their culinary preferences. The convenience and accessibility of supermarkets and hypermarkets further contribute to their prominence, as they are widely available and strategically located, facilitating easy access for consumers seeking to purchase sauces. Promotional opportunities, such as discounts and promotions, are frequently leveraged by these retail channels, attracting price-conscious consumers and fostering increased sales. Moreover, supermarkets and hypermarkets serve as a platform for brand exposure, allowing sauce manufacturers to showcase their products to a large audience ultimately boosting brand awareness and recognition. The impact of these retail giants extends to shaping consumer trends and preferences, with their ability to adapt product offerings in response to market demands. They also play an important role in product innovation and launches, serving as a launchpad for new sauce products and driving market expansion. Competitive pricing strategies among supermarkets and hypermarkets benefit consumers by providing more affordable sauce options, and their global reach facilitates the distribution of sauces on an international scale, promoting cultural exchange through diverse culinary experiences. The online segment of the sauce market is experiencing rapid growth, fueled by the widespread adoption of e-commerce, convenience, and an expansive product range. Online retailers offer diverse sauces, including specialty and gourmet varieties not easily found in physical stores. Factors driving this growth include the convenience of home shopping, a broader sauce selection, price comparisons, and reviews for informed decision-making. Subscription services and personalized recommendations further grow the online shopping experience. This digital shift has significant impacts, increasing market reach, enabling direct-to-consumer sales, fostering global expansion, providing data-driven insights, and influencing evolving consumer preferences. As online retail continues to thrive, its role in the sauce market is expected to grow driving innovation and reshaping consumer habits. Convenience stores play a smaller role in the sauce market compared to supermarkets and hypermarkets still offer a limited yet convenient selection for on-the-go consumers. Their constrained role is influenced by factors such as limited space, a focus on high-turnover items, and catering to customers seeking quick purchases. However, convenience stores contribute to the sauce market by providing accessibility and convenience for those in need of sauces urgently. The layout encourages impulse purchases, supporting both popular and local brands. As convenience stores develop to accommodate changing preferences, their role in the sauce market may rise catering to specific needs and potentially offering a more diverse sauce selection in the future.

Sauces Market Regional Insights:

North America led the global Sauces market with the highest market share of 46% in 2022. The region is further expected to grow at a CAGR and maintain its dominance throughout the forecast period. The strong adoption of various Sauces across the business is expected to be the major factor driving the regional market growth. In addition, the region is further expected to continue to maintain its dominance throughout the forecast period due to the demand for products such as ketchup, mayonnaise, barbecue sauce, hot sauce, salsa, and various ethnic sauces. The United States is expected to be the lucrative region for the global sauce market vendors with a diverse product such as ketchup, mayonnaise, barbecue sauce, hot sauce, and ethnic sauces. The United States sauces market is witnessing robust growth due to rising consumer demand for convenient, flavorful meals and the expanding popularity of diverse ethnic cuisines. With a focus on health, rise in the adoption of healthy sauces amidst increasing urbanization and busy lifestyles. Ketchup, mayonnaise, mustard, soy sauce, hot sauce, salad dressings, and other sauces are segmented across various distribution channels, including supermarkets, convenience stores, and online retailers. Major players such as Kraft Heinz, Conagra Brands, and Unilever dominate the fragmented market. Key trends include the rising demand for organic and natural sauces, alongside the growing popularity of ethnic varieties. Anticipated to flourish, the market aligns with the increasing trend of home cooking.Canada region is expected to experience steady growth, attributed to its increasing consumer demand for convenient and flavorful meals and growing popularity of ethnic cuisines. For example, hot sauce, teriyaki sauce, and soy sauce are all becoming increasingly popular in Canada. Also Canadians are becoming more health-conscious because of that leading to a growing demand for healthy sauces. This includes sauces that are low in calories, sugar, and fat, as well as sauces that are made with natural ingredients. Additionaly, Canadians' hectic schedules and a desire for quick, flavorful meals drive a rise in sauce popularity. Exploring diverse global cuisines canadians favor sauces such as hot sauce and teriyaki, reflecting a cultural shift. The rising health consciousness fuels a demand for sauces with low-calorie, low-sugar, and natural ingredient profiles. In urbanized settings sauces offer a time-saving solution for busy lifestyles, aligning with the evolving preferences of the Canadian population. Asia Pacific region is expected to be the potential market for Sauces market vendors during the forecast period. The region held a market share and is expected to grow at a CAGR of during the forecast period. With the rising disposable incomes, changing consumer preferences, and growing popularity of ethnic cuisines, the region offers immense opportunities. The increasing demand for natural and organic sauces the growing popularity of fusion sauces in countries like China and India, is further expected to drive the Asia Pacific Sauces market growth.

China is expected to be an emerging country in the global Sauces market. The Chinese sauce market is growing due to increased disposable incomes, evolving consumer tastes favoring healthier options, and a rising in interest for global cuisines. Leading players include Haitian Flavouring, Lee Kum Kee, Unilever, and Nestlé. With the booming e-commerce sector, future prospects remain promising, ensuring sustained growth in the Chinese sauce market.

Sauces Market Scope: Inquiry Before Buying

Sauces Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 55.4 Bn. Forecast Period 2023 to 2029 CAGR: 4.96% Market Size in 2029: US $ 77.79 Bn. Segments Covered: by Packaging Bottles and Jars Pouches and Sachets Others by Type Hot Sauces Soy Sauce Barbecue Sauce Ketchup Mustard Sauce Others by Distribution Channel Supermarket and Hypermarket Convenience Store Online Others Sauces Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sauces Market Key Players:

1. Gehl Foods 2. AFP 3. Barilla Alimentare SpA 4. Bay Valley 5. Berner Foods 6. Campbell Soup 7. Casa Fiesta 8. Conad 9. Concord Foods 10. Coop Italia Scarl 11. Frito Lay 12. Funacho 13. General Mills 14. Haitian Flavouring 15. Hormel Foods 16. Jiajia 17. Kerry Group 18. Kewpie 19. Kikkoman 20. Knorr 21. Kraft Foods 22. Kroger 23. Lee Kum Kee 24. Mars 25. McCormick 26. McDonalds 27. Meiweixian 28. Nestlé 29. Prego 30. Ragu 31. Ricos 32. Shinho 33. Shoda Shoyu 34. Tatua 35. The Clorox 36. Unilever 37. YamasaFAQs:

1. What are the growth drivers for the Sauces market? Ans. Increasing Consumer Demand for Variety and Flavor are expected to be the major driver for the Sauces market. 2. What is the major restraint on the Sauces market growth? Ans. Rising Raw Material Costs are expected to be the major restraining factor for the Sauces market growth. 3. Which region is expected to lead the global Sauces market during the forecast period? Ans. North America is expected to lead the global Sauces market during the forecast period. 4. What is the projected market size & and growth rate of the Sauces Market? Ans. The Sauces Market size was valued at USD 55.4 Billion in 2022 and the total Sauces revenue is expected to grow at a CAGR of 4.96 % from 2023 to 2029, reaching nearly USD 77.79 Billion. 5. What segments are covered in the Sauces Market report? Ans. The segments covered in the Sauces market report are Type, Product, Distribution channel and Region.

1. Sauces Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Sauces Market: Dynamics 2.1. Sauces Market Trends by Region 2.1.1. North America Sauces Market Trends 2.1.2. Europe Sauces Market Trends 2.1.3. Asia Pacific Sauces Market Trends 2.1.4. Middle East and Africa Sauces Market Trends 2.1.5. South America Sauces Market Trends 2.1.6. Preference Analysis 2.2. Sauces Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Sauces Market Drivers 2.2.1.2. North America Sauces Market Restraints 2.2.1.3. North America Sauces Market Opportunities 2.2.1.4. North America Sauces Market Challenges 2.2.2. Europe 2.2.2.1. Europe Sauces Market Drivers 2.2.2.2. Europe Sauces Market Restraints 2.2.2.3. Europe Sauces Market Opportunities 2.2.2.4. Europe Sauces Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Sauces Market Drivers 2.2.3.2. Asia Pacific Sauces Market Restraints 2.2.3.3. Asia Pacific Sauces Market Opportunities 2.2.3.4. Asia Pacific Sauces Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Sauces Market Drivers 2.2.4.2. Middle East and Africa Sauces Market Restraints 2.2.4.3. Middle East and Africa Sauces Market Opportunities 2.2.4.4. Middle East and Africa Sauces Market Challenges 2.2.5. South America 2.2.5.1. South America Sauces Market Drivers 2.2.5.2. South America Sauces Market Restraints 2.2.5.3. South America Sauces Market Opportunities 2.2.5.4. South America Sauces Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For Sauces Industry 2.9. Analysis of Government Schemes and Initiatives For Sauces Industry 2.10. The Global Pandemic Impact on Sauces Market 2.11. Sauces Price Trend Analysis (2021-22) 3. Sauces Market: Global Market Size and Forecast by Segmentation (by Value and Volume) (2022-2029) 3.1. Sauces Market Size and Forecast, by Packaging (2022-2029) 3.1.1. Bottles and Jars 3.1.2. Pouches and Sachets 3.1.3. Others 3.2. Sauces Market Size and Forecast, by Type (2022-2029) 3.2.1. Hot Sauces 3.2.2. Soy Sauce 3.2.3. Barbecue Sauce 3.2.4. Ketchup 3.2.5. Mustard Sauce 3.2.6. Others 3.3. Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Supermarket and Hypermarket 3.3.2. Convenience Store 3.3.3. Online 3.3.4. Others 3.4. Sauces Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Sauces Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 4.1. North America Sauces Market Size and Forecast, by Packaging (2022-2029) 4.1.1. Bottles and Jars 4.1.2. Pouches and Sachets 4.1.3. Others 4.2. North America Sauces Market Size and Forecast, by Type (2022-2029) 4.2.1. Hot Sauces 4.2.2. Soy Sauce 4.2.3. Barbecue Sauce 4.2.4. Ketchup 4.2.5. Mustard Sauce 4.2.6. Others 4.3. North America Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Supermarket and Hypermarket 4.3.2. Convenience Store 4.3.3. Online 4.3.4. Others 4.4. North America Sauces Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Sauces Market Size and Forecast, by Packaging (2022-2029) 4.4.1.1.1. Bottles and Jars 4.4.1.1.2. Pouches and Sachets 4.4.1.1.3. Others 4.4.1.2. United States Sauces Market Size and Forecast, by Type (2022-2029) 4.4.1.2.1. Hot Sauces 4.4.1.2.2. Soy Sauce 4.4.1.2.3. Barbecue Sauce 4.4.1.2.4. Ketchup 4.4.1.2.5. Mustard Sauce 4.4.1.2.6. Others 4.4.1.3. United States Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.3.1. Supermarket and Hypermarket 4.4.1.3.2. Convenience Store 4.4.1.3.3. Online 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Sauces Market Size and Forecast, by Packaging (2022-2029) 4.4.2.1.1. Bottles and Jars 4.4.2.1.2. Pouches and Sachets 4.4.2.1.3. Others 4.4.2.2. Canada Sauces Market Size and Forecast, by Type (2022-2029) 4.4.2.2.1. Hot Sauces 4.4.2.2.2. Soy Sauce 4.4.2.2.3. Barbecue Sauce 4.4.2.2.4. Ketchup 4.4.2.2.5. Mustard Sauce 4.4.2.2.6. Others 4.4.2.3. Canada Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Supermarket and Hypermarket 4.4.2.3.2. Convenience Store 4.4.2.3.3. Online 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Sauces Market Size and Forecast, by Packaging (2022-2029) 4.4.3.1.1. Bottles and Jars 4.4.3.1.2. Pouches and Sachets 4.4.3.1.3. Others 4.4.3.2. Mexico Sauces Market Size and Forecast, by Type (2022-2029) 4.4.3.2.1. Hot Sauces 4.4.3.2.2. Soy Sauce 4.4.3.2.3. Barbecue Sauce 4.4.3.2.4. Ketchup 4.4.3.2.5. Mustard Sauce 4.4.3.2.6. Others 4.4.3.3. Mexico Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Supermarket and Hypermarket 4.4.3.3.2. Convenience Store 4.4.3.3.3. Online 4.4.3.3.4. Others 5. Europe Sauces Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 5.1. Europe Sauces Market Size and Forecast, by Packaging (2022-2029) 5.2. Europe Sauces Market Size and Forecast, by Type (2022-2029) 5.3. Europe Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Sauces Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Sauces Market Size and Forecast, by Packaging (2022-2029) 5.4.1.2. United Kingdom Sauces Market Size and Forecast, by Type (2022-2029) 5.4.1.3. United Kingdom Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.2. France 5.4.2.1. France Sauces Market Size and Forecast, by Packaging (2022-2029) 5.4.2.2. France Sauces Market Size and Forecast, by Type (2022-2029) 5.4.2.3. France Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Sauces Market Size and Forecast, by Packaging (2022-2029) 5.4.3.2. Germany Sauces Market Size and Forecast, by Type (2022-2029) 5.4.3.3. Germany Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Sauces Market Size and Forecast, by Packaging (2022-2029) 5.4.4.2. Italy Sauces Market Size and Forecast, by Type (2022-2029) 5.4.4.3. Italy Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Sauces Market Size and Forecast, by Packaging (2022-2029) 5.4.5.2. Spain Sauces Market Size and Forecast, by Type (2022-2029) 5.4.5.3. Spain Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Sauces Market Size and Forecast, by Packaging (2022-2029) 5.4.6.2. Sweden Sauces Market Size and Forecast, by Type (2022-2029) 5.4.6.3. Sweden Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Sauces Market Size and Forecast, by Packaging (2022-2029) 5.4.7.2. Austria Sauces Market Size and Forecast, by Type (2022-2029) 5.4.7.3. Austria Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Sauces Market Size and Forecast, by Packaging (2022-2029) 5.4.8.2. Rest of Europe Sauces Market Size and Forecast, by Type (2022-2029) 5.4.8.3. Rest of Europe Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Sauces Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Sauces Market Size and Forecast, by Packaging (2022-2029) 6.2. Asia Pacific Sauces Market Size and Forecast, by Type (2022-2029) 6.3. Asia Pacific Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Sauces Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.1.2. China Sauces Market Size and Forecast, by Type (2022-2029) 6.4.1.3. China Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.2.2. S Korea Sauces Market Size and Forecast, by Type (2022-2029) 6.4.2.3. S Korea Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.3.2. Japan Sauces Market Size and Forecast, by Type (2022-2029) 6.4.3.3. Japan Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.4.2. India Sauces Market Size and Forecast, by Type (2022-2029) 6.4.4.3. India Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.5.2. Australia Sauces Market Size and Forecast, by Type (2022-2029) 6.4.5.3. Australia Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.6.2. Indonesia Sauces Market Size and Forecast, by Type (2022-2029) 6.4.6.3. Indonesia Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.7.2. Malaysia Sauces Market Size and Forecast, by Type (2022-2029) 6.4.7.3. Malaysia Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.8.2. Vietnam Sauces Market Size and Forecast, by Type (2022-2029) 6.4.8.3. Vietnam Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.9.2. Taiwan Sauces Market Size and Forecast, by Type (2022-2029) 6.4.9.3. Taiwan Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Sauces Market Size and Forecast, by Packaging (2022-2029) 6.4.10.2. Rest of Asia Pacific Sauces Market Size and Forecast, by Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Sauces Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 7.1. Middle East and Africa Sauces Market Size and Forecast, by Packaging (2022-2029) 7.2. Middle East and Africa Sauces Market Size and Forecast, by Type (2022-2029) 7.3. Middle East and Africa Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Sauces Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Sauces Market Size and Forecast, by Packaging (2022-2029) 7.4.1.2. South Africa Sauces Market Size and Forecast, by Type (2022-2029) 7.4.1.3. South Africa Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Sauces Market Size and Forecast, by Packaging (2022-2029) 7.4.2.2. GCC Sauces Market Size and Forecast, by Type (2022-2029) 7.4.2.3. GCC Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Sauces Market Size and Forecast, by Packaging (2022-2029) 7.4.3.2. Nigeria Sauces Market Size and Forecast, by Type (2022-2029) 7.4.3.3. Nigeria Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Sauces Market Size and Forecast, by Packaging (2022-2029) 7.4.4.2. Rest of ME&A Sauces Market Size and Forecast, by Type (2022-2029) 7.4.4.3. Rest of ME&A Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Sauces Market Size and Forecast by Segmentation (by Value in USD Million) (2022-2029) 8.1. South America Sauces Market Size and Forecast, by Packaging (2022-2029) 8.2. South America Sauces Market Size and Forecast, by Type (2022-2029) 8.3. South America Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 8.4. South America Sauces Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Sauces Market Size and Forecast, by Packaging (2022-2029) 8.4.1.2. Brazil Sauces Market Size and Forecast, by Type (2022-2029) 8.4.1.3. Brazil Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Sauces Market Size and Forecast, by Packaging (2022-2029) 8.4.2.2. Argentina Sauces Market Size and Forecast, by Type (2022-2029) 8.4.2.3. Argentina Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Sauces Market Size and Forecast, by Packaging (2022-2029) 8.4.3.2. Rest Of South America Sauces Market Size and Forecast, by Type (2022-2029) 8.4.3.3. Rest Of South America Sauces Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Sauces Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Packaging Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Sauces Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Gehl Foods 10.2. Company Overview 10.3. Business Portfolio 10.4. Financial Overview 10.5. SWOT Analysis 10.6. Strategic Analysis 10.7. Scale of Operation (small, medium, and large) 10.8. Details on Partnership 10.9. Regulatory Accreditations and Certifications Received by Them 10.10. Awards Received by the Firm 10.11. Recent Developments 10.11.1. AFP 10.11.2. Barilla Alimentare SpA 10.11.3. Bay Valley 10.11.4. Berner Foods 10.11.5. Campbell Soup 10.11.6. Casa Fiesta 10.11.7. Conad 10.11.8. Concord Foods 10.11.9. Coop Italia Scarl 10.11.10. Frito Lay 10.11.11. Funacho 10.11.12. General Mills 10.11.13. Haitian Flavouring 10.11.14. Hormel Foods 10.11.15. Jiajia 10.11.16. Kerry Group 10.11.17. Kewpie 10.11.18. Kikkoman 10.11.19. Knorr 10.11.20. Kraft Foods 10.11.21. Kroger 10.11.22. Lee Kum Kee 10.11.23. Mars 10.11.24. McCormick 10.11.25. McDonalds 10.11.26. Meiweixian 10.11.27. Nestlé 10.11.28. Prego 10.11.29. Ragu 10.11.30. Ricos 10.11.31. Shinho 10.11.32. Shoda Shoyu 10.11.33. Tatua 10.11.34. The Clorox 10.11.35. Unilever 10.11.36. Yamasa 11. Key Findings 12. Industry Recommendations 13. Sauces Market: Research Methodology 14. Terms and Glossary